Why Physical Skills Matter More Than Ever

Building Things in the Age of AI

Introduction

As AI continues to reshape the digital landscape, there's a growing conversation about what skills will remain valuable. While everyone rushes to learn prompt engineering and AI tools, I believe we're overlooking something crucial: physical skills and the ability to work with tangible materials.

The ability to solder a circuit, use a power tool, or build a prototype with your hands is becoming increasingly rare - and increasingly valuable. In a world where AI can generate code and designs in seconds, the people who can actually make things real will stand out.

The Complete Builder

There's something powerful about being able to take a project from concept to completion without relying on others. When you understand both the digital and physical aspects of building, you can see a project all the way through. You're not dependent on finding someone who can "do the hardware part" or waiting for a specialist to be available.

This independence is liberating. You can prototype faster, iterate more freely, and truly own your creations from start to finish.

AI Can't Solder (Yet)

AI is remarkable at generating text, code, and images. But it can't wire up a Raspberry Pi, adjust a servo motor, or debug why your LED strip isn't lighting up the way it should. These physical debugging skills - the ability to troubleshoot with a multimeter, identify a loose connection, or understand why a mechanical part isn't moving correctly - remain deeply human.

As more people lean entirely into digital skills, those who can bridge the physical-digital divide become more valuable, not less.

The Skilled Trades Gap

We're already seeing shortages of skilled physical workers - electricians, machinists, technicians. As automation increases in some areas, it creates demand in others. Someone needs to build, maintain, and repair the physical infrastructure that our digital world runs on.

Understanding physical tools and materials isn't just about career security - it's about being a more complete problem solver.

Learning by Making

There's also something about working with physical materials that deepens understanding in ways that pure digital work doesn't. When you build a circuit, you understand electricity differently. When you construct a mechanism, you grasp physics intuitively. This embodied knowledge makes you better at digital design too - you understand constraints, tolerances, and real-world behavior.

My Experience

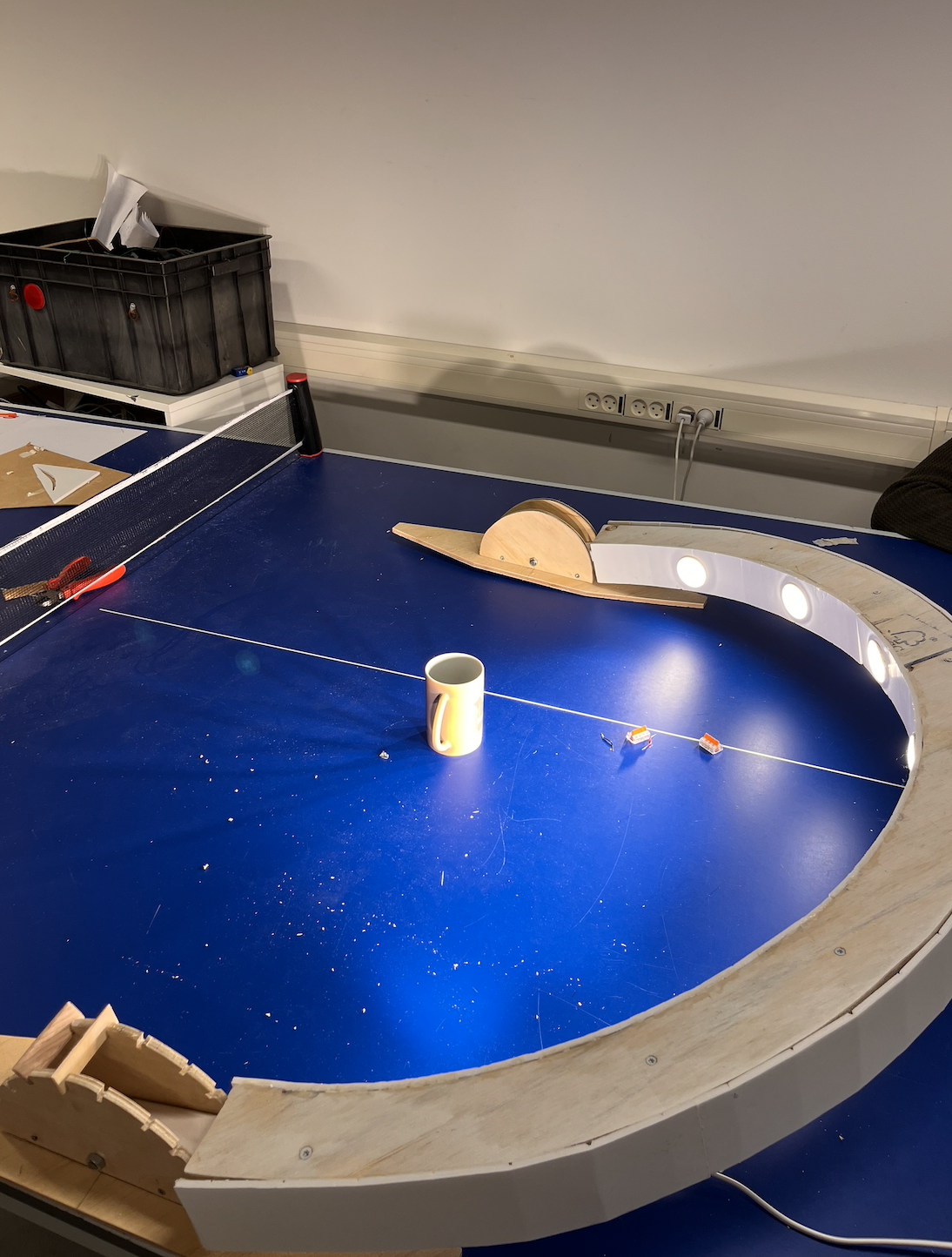

Through projects like building autonomous tracking devices, interactive lighting systems, and physical computing games, I've experienced firsthand how valuable it is to work across both domains. The projects that excite me most are the ones where software meets hardware - where code controls motors, sensors feed data, and users interact with something tangible.

These skills take time to develop, but they're worth the investment. Start small - build a simple circuit, take apart an old device, learn to use basic tools. The confidence that comes from making something physical is unlike anything else.

Conclusion

In the AI age, don't neglect the physical. The most valuable builders will be those who can move fluidly between digital and physical, who can prototype in code and in cardboard, who can debug software and hardware alike.

Being able to see a project through from idea to tangible reality - without depending on others for the "physical parts" - is a superpower worth developing.

The Promise and Peril of

DeFi

Exploring the World of Decentralized Finance

Introduction

Decentralized Finance, or DeFi, is a financial revolution that has taken the world by storm in recent years. Enabled by blockchain technology, DeFi promises to democratize finance, providing access to financial services and products that were once the exclusive domain of traditional banks and institutions. While DeFi holds immense potential for financial inclusion and innovation, it is not without its share of risks and challenges. In this blog post, we will explore the possibilities, pros, and cons of DeFi, with a critical perspective on the dangers it presents.

The Promise of DeFi

Financial Inclusion: DeFi has the power to bring millions of unbanked and underbanked people into the global financial system. By utilizing blockchain technology and smart contracts, it enables peer-to-peer lending, borrowing, and investing, allowing individuals to access financial services without intermediaries.

Transparency: DeFi operates on public, transparent, and immutable blockchain networks. This transparency can help eliminate fraud, reduce corruption, and build trust in the financial ecosystem.

Accessibility: Anyone with an internet connection and a digital wallet can participate in DeFi. This open access empowers people to take control of their finances, reducing the need for traditional banks and intermediaries.

Innovation: DeFi is a hotbed for innovation. Developers worldwide are creating new financial products, from decentralized exchanges to yield farming protocols, that challenge traditional banking systems and redefine how people manage their wealth.

The Pros of DeFi

Eliminating Intermediaries: DeFi cuts out middlemen, reducing fees and the time it takes to process financial transactions. This is particularly advantageous in cross-border payments and remittances.

Enhanced Security: Blockchain technology and smart contracts offer robust security features that make it difficult for malicious actors to manipulate the system. This can help reduce the risk of hacks and fraud.

Yield Opportunities: DeFi platforms often offer high-yield opportunities for users to earn interest on their assets through lending, liquidity provision, or yield farming.

The Cons of DeFi

Regulatory Challenges: The decentralized nature of DeFi makes it challenging for governments to regulate and oversee. This lack of regulation can lead to potential risks for investors and the misuse of DeFi platforms.

Smart Contract Vulnerabilities: While smart contracts are designed to be secure, vulnerabilities can still exist. Bugs or coding errors can result in substantial financial losses for users, as seen in various DeFi hacks.

Lack of Insurance: Traditional financial institutions often provide insurance to protect customers from losses. DeFi, on the other hand, lacks such safety nets, leaving users exposed to the risk of losing their assets in the event of an unforeseen event.

The Dangers of DeFi

Risk of Exploitation: DeFi platforms can be exploited by malicious actors who find weaknesses in smart contracts, leading to substantial financial losses for users.

Flash Loans: Flash loans allow users to borrow large sums of cryptocurrency without collateral, potentially causing price manipulation and market instability.

Market Volatility: DeFi platforms can be highly susceptible to price volatility, as assets are often used as collateral. A sudden market crash can lead to a cascade of liquidations and significant losses for users.

Conclusion

DeFi is a groundbreaking innovation with the potential to revolutionize the financial industry and empower individuals globally. However, it comes with its set of challenges and risks that cannot be overlooked. It is crucial for users, developers, and regulators to strike a balance between embracing the potential of DeFi and addressing its dangers.

As the DeFi ecosystem continues to evolve, responsible adoption and regulatory oversight will be essential to ensure that the promises of financial inclusion and innovation are achieved while mitigating the potential perils that could undermine its transformative potential. In the coming years, DeFi will undoubtedly remain a topic of great interest, as we navigate the uncharted waters of decentralized finance.